Can you claim tax benefit for tax paid on insurance premium?, ET RISE MSME DAY

Section 80C and 80D of Income-tax Act entitles specified taxpayers to claim deductions for the entire amount paid to the insurance company for specified insurance schemes.

Who Can Benefit from Presumptive Taxation for Small MSME Businesses and Professionals?, by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager, Feb, 2024

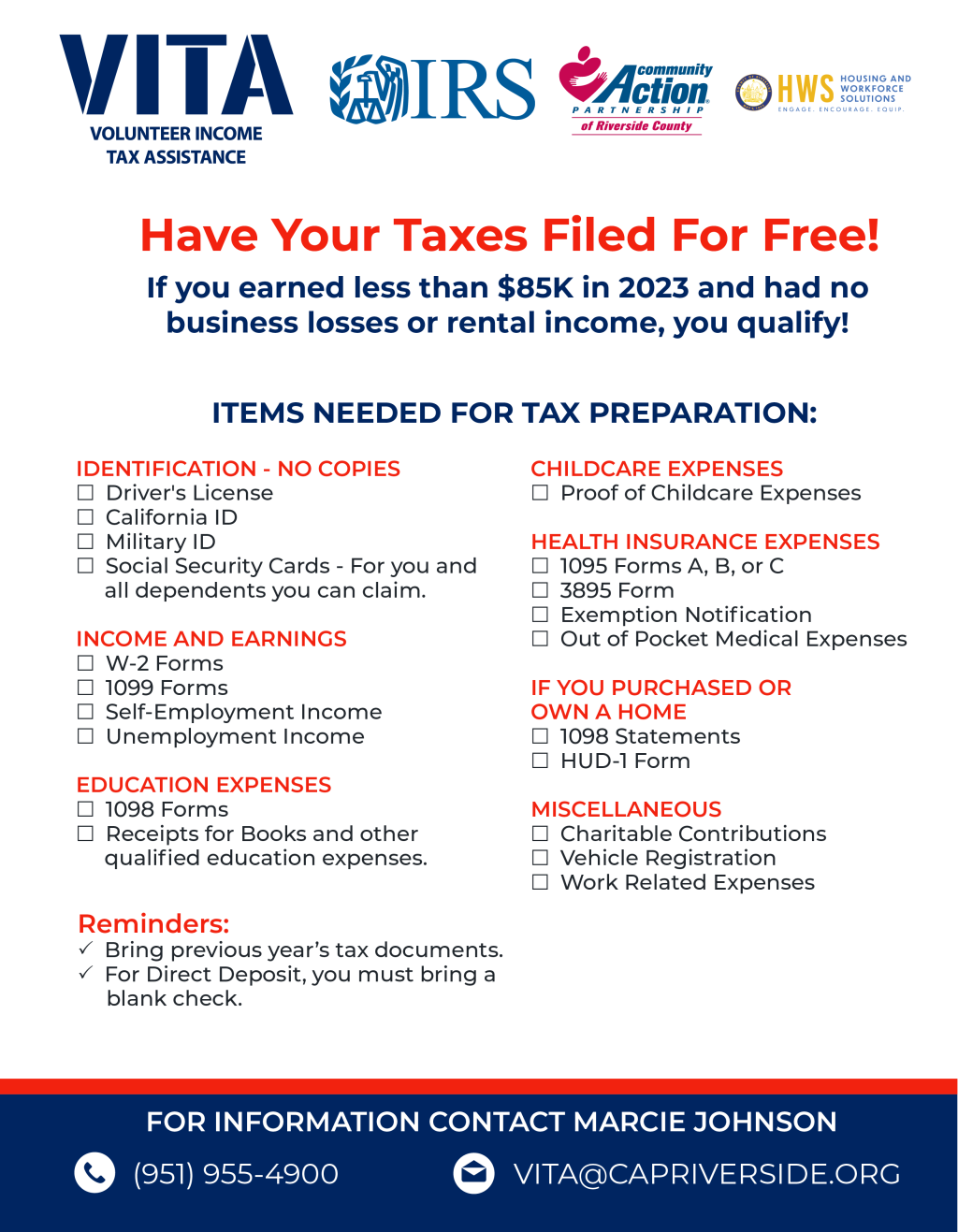

Earned Income Tax Credit Day, January 26, 2024 Community Action Partnership of Riverside County

How Can I Pay My Life Insurance With Pre-Tax Dollars Rather Than After-Tax Dollars?

Business Income-Tax Deductions for Life-Insurance Premiums

:max_bytes(150000):strip_icc()/form89622022-834fab55d8834938aff6b97f746f693a.jpg)

Form 8962: Premium Tax Credit. What It Is and How to File

MSME Registration Benefits – Tax and Others

Are Life Insurance Premiums Tax-Deductible In Canada?

How to reconcile your premium tax credit

2019 IRS Health Insurance Premium Tax Credit Reconciliation

Are Insurance Premiums Tax Deductible in Ontario & Canada? - Excalibur Blog

Guide to Deductible Business Expenses

Health Insurance Tax Benefits For Small-Business Owners

nri tax filing: How to file income tax returns: A step-by-step guide for NRIs - Step 1: Find out your Residential Status

Documents - How to claim tax benefits on medical insurance premium